US equity valuations

The outlook for the US stock market looks unusually poor.

(Nothing in this post is financial advice, and it does not represent the views of my employer.)

Expected returns are low

Aswath Damodaran, an academic who studies valuation, publishes regular estimates of the expected return on equity investments. This is constructed from public company earnings forecasts (sourced from investment bank research reports). As of 2020, the expected returns to holding equity look worse than at any time since the 1960s:

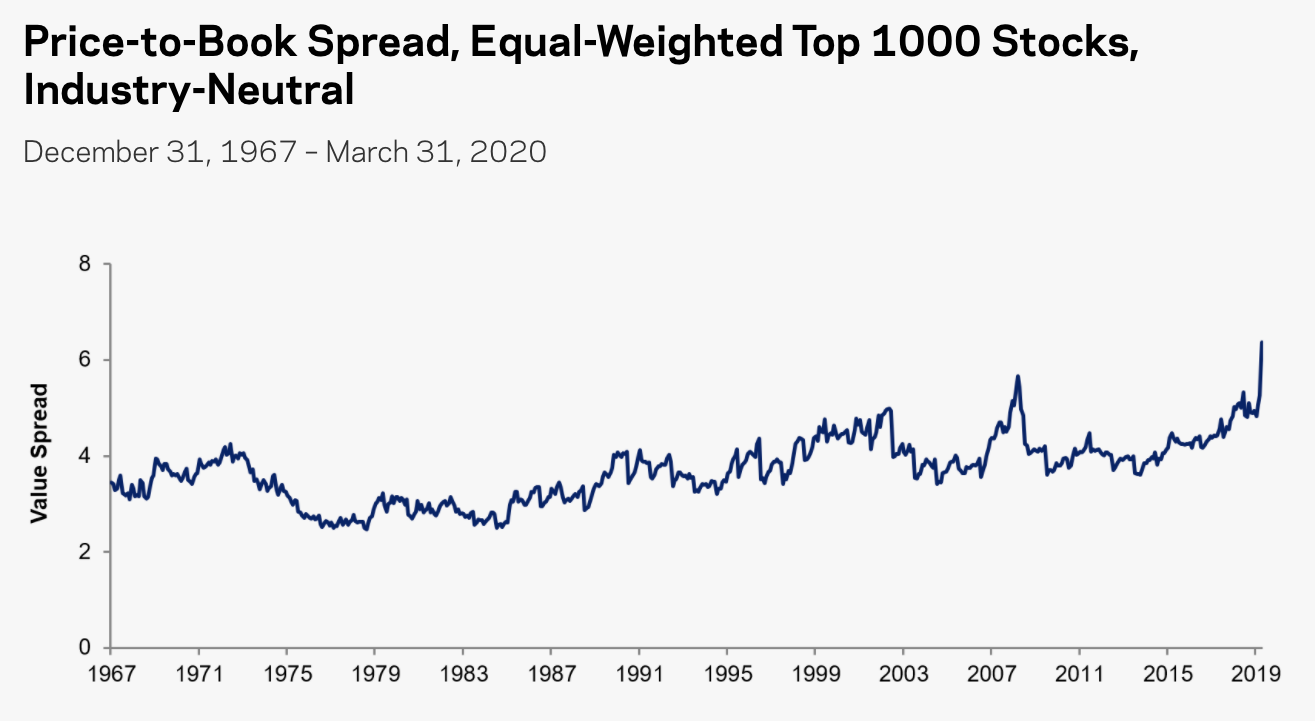

Cliff Asness runs AQR, one of the largest quantitative investment managers in the world. In an early-2020 article he points out that, measured by their stock-price-to-book-value ratio, high-growth stocks are today about 6 times as expensive as low-growth stocks, which is historically unprecedented. I’m sure this ratio is even higher today:

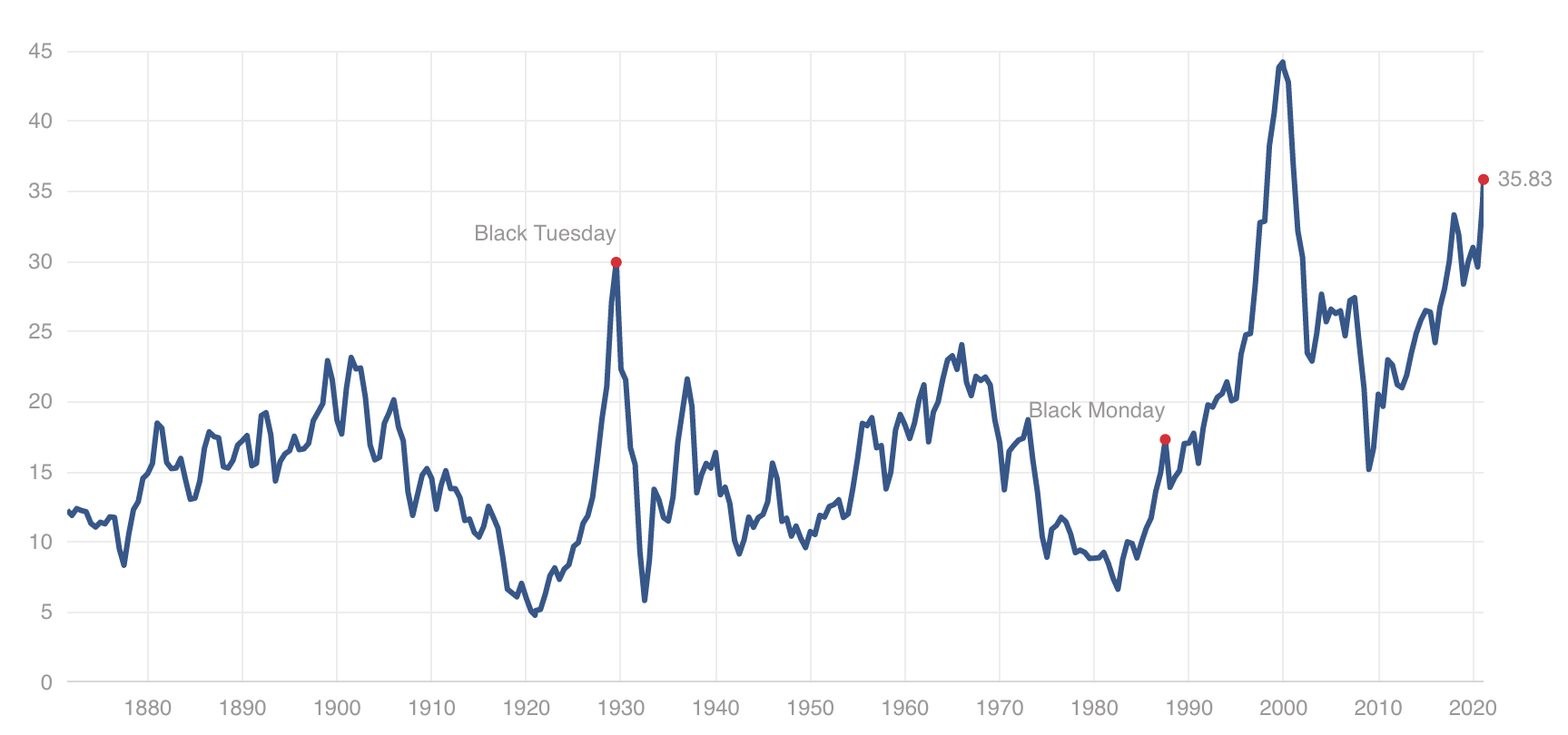

A more common metric of equity market valuation is the Shiller price-to-earnings ratio of the S&P 500. By this metric, US bigcaps are more expensive than at any time since 2000:

Sentiment is strong

There were 464 IPOs1 in 2020: the most in any year since 1999. A classic measure of the level of exuberance in the market is the first-day return earned by investing in an IPO (the “IPO pop”). In 2020, the average first-day return was 41.6%, the highest since 2000.

IPO activity was subdued for the first few months of 2020 due to the pandemic. If you measure the IPO pop over just the last few months of 2020, it looks even higher: maybe 46-52%.

US investor sentiment is clearly exceptionally strong, which is a bit confusing given that the real economy is in tatters, US politics is in gridlock, and the 2020s look to be the pivotal decade in which China will overtake the US as the leading world power. Perhaps this bullish sentiment is justified, but it’s a little difficult for me to see why.

Low-information retail traders are piling in

Retail investors are making up an increasing amount of the market. Federal Reserve data shows that the US personal savings rate is at levels that haven’t been seen since the 1970s. The reason for this is that people are stuck at home with little to spend their savings on, and the US government is handing out stimulus cheques and other forms of income support with wild abandon. A lot of these savings are ending up in the stock market.

Retail investors characteristically like to invest in products with lottery-like payoffs: i.e. negative expected return, but with a low-probability possibility of a huge upside. Two classic ways to buy a lottery ticket in the stock market are to trade options, and to invest in penny stocks.

What we see is that the use of options is at almost an all-time high: equity option volumes are up 80% versus the same period last year. (Notoriously, retail traders used the leverage afforded by these options to enormously drive up the price of Gamestop Corp.) The increased use of options may partly be caused by new fintech entrants like Robinhood that make it easier than ever for retail clients to begin option trading.

In the penny stock arena, data shows that 2020 experienced unprecedented levels of trading:

We also see retail enthusiasm spilling over into the crypto markets, where Bitcoin, Ethereum and Dogecoin have been rallying hugely as money pours into these highly volatile assets.

What are the risks?

Although several alarm bells are ringing, and valuations look a bit overheated, it’s not at all clear to me that there is any immediate danger of a huge stock price crash.

One commonly-cited catalyst for a crash is that Biden is expected to raise the corporate tax rate to 28%. When Trump cut the rate from 35% to 21% in 2017, this was regarded as being a key factor in the 2017 to early-2018 equity market rally. An announcement of a tax rate increase by the new administration could conceivably act as a shock in the other direction in the near-term. However, this is not necessarily a 100% convincing argument: for example, you could counter that if the US authorizes $2k stimulus cheques, that will provide a second wind to the retail inflows and push the markets to even greater heights.

In my view it is completely possible that equity prices just continue to grow for years to come, even in defiance of the fundamentals, in a pure Keynesian beauty contest fuelled by institutional investors seeking yield and by easy money from the Fed’s low interest rate policies. There is evidence that since the 1990s, increases in equity market valuation have been substantially driven by FOMC decisions, so the Federal Reserve clearly has enormous power to pump the market, and there is no near-term sign of this power facing any challenges.

What’s more, there is (almost) no alternative to owning US equities:

-

International equities don’t offer the same breadth of investment possibilities, particularly in the technology sector. Whatever you think about the valuation of these tech companies, I think it’s important to own a bit of them, even if for no other reason than to hedge the “AI risk” that software continues to eat the world, and actually automates you out of a job!

-

Traditional alternatives like fixed income products now offer negative real yields. This is most notable in the EU and environs, where nominal rates are negative: in Denmark, you can now actually get paid to take out of mortgage. Furthermore, with Federal Reserve money creation also at extremely high levels, and big federal spending expansion expected, there is an elevated risk of inflation. Fixed income products are exposed to this risk in a way that equities mostly are not.

So, are these indicators totally non-actionable? Perhaps. Nonetheless, I think it may be worth downweighting the US a little bit at this point. Personally I’m looking at rotating some of my own savings into international equities (particularly mainland China), and exploring opportunities to earn high yields in the crypto space.

-

When including SPACs, CEFs and REIT offerings in the count of IPOs. ↩