Making money in cryptocurrency without price risk

Cryptocurrency trading is a high-risk business, with annualized volatility of many tokens exceeding 100%. While I think that every investor should hold some Bitcoin (as part of holding the CAPM market portfolio), it’s probably unwise to commit more than a few percentage points of your net worth.

However – there are ways to make money in crypto that do not involve taking on any price risk! In this post I will describe five strategies that I’ve been trading in my personal account with some success.

Margin lending

BitFinex is one of the major cryptocurrency exchanges. As well as offering “cash” trading, it lets investors trade on margin. If a margin trader wants to take a leveraged position in, say, Bitcoin they need to borrow dollars to purchase the coin. On BitFinex, these dollars are provided by other users of BitFinex who have deposited them on the exchange and made them available for lending.

When you lend dollars on BitFinex you lose the use of the dollars for a short fixed term. The borrower may repay the loan at any time during the term, but while the loan remains open you receive interest. Historically, the interest rate has been very substantial – often in excess of 100% annualized!

Implementing this trade is fairly straightforward:

- Deposit USD. You pay 0.1% to do this via a bank transfer. - At one time, BitFinex did not support USD deposits, so the only way to get USD on the system was to buy cryptocurrency elsewhere, transfer it to BitFinex, and then sell it for USD. This may still be cheaper/easier than arranging a bank transfer.

- Set up MarginBot to automatically offer your dollars on the lending market.

At the time of writing, this is not a particularly profitable strategy – after BitFinex take their 15% cut of the interest paid, you can expect to make only about 4.5% annualized. In my opinion this return is not sufficient to compensate you for the risks of the investment, namely:

- Tether risk: when you own USD on BitFinex you don’t own real dollars, but rather units a token called “TetherUSD”. This token is somewhat dodgy:

- It is theoretically redeemable at the issuer for real dollars, but the issuer has not had functioning international banking relationships since April 2017, making this something of a moot point. (It is, however, generally possible to trade it 1:1 for real dollars at Kraken.)

- Accusations are occasionally thrown around suggesting that Tether is not actually backed 1-for-1 with real dollars. Personally I don’t believe this, but it is a risk – it is particularly strange that the audit that had been comissioned to put paid to this accusation never happened.

- I think it is somewhat likely that Tether will be shut down as a money laundering scheme in the medium-to-long term.

- Hack risk: around 2016-08-03, BitFinex was hacked, and they socialized the resulting losses across all customers of the platform, resulting in a 36% haircut to everyone’s positions. They did eventually make everyone whole again, presumably from the substantial trading profits generated by the exchange, so my backtest results above do not account for this loss.

- Margin lending risk: when you lend to a margin trader, your funds are secured by the cryptocurrency that the trader purchases. If their position value gets too low, the BitFinex platform will automatically sell it in the market to make sure that sufficient funds are available to repay the margin loan. However, in unusual market conditions with fast price changes or thin books, it may not be possible to liquidate all traders in the market without imposing losses on the lenders.

- Fixed term lending risk: you cannot close the loan out early if you need the funds in a hurry. This is mitigated by the fact that the usual lending period is only 2 days.

That all being said, I think it is somewhat likely that the returns to margin lending will at some point improve to something like their historical norms.

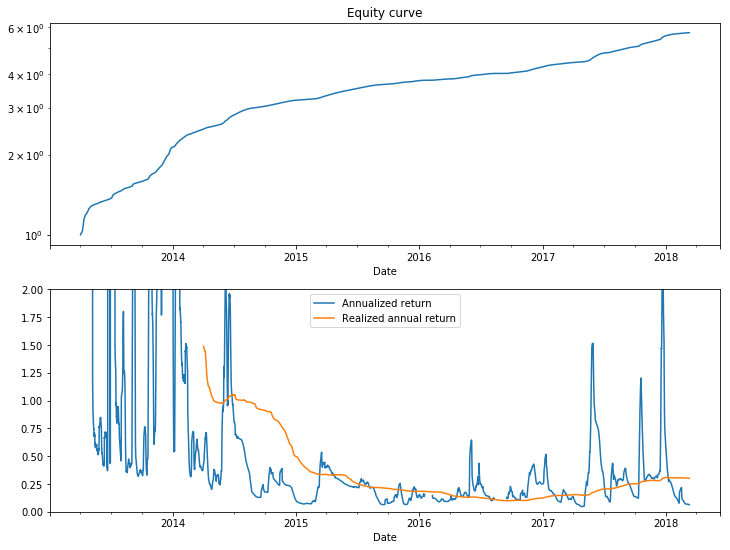

| Annualized returns | |

|---|---|

| 2015 | 18.4% |

| 2016 | 12.4% |

| 2017 | 30.9% |

| 2018 to date | 15.2% |

| Post-hack to date | 24.5% |

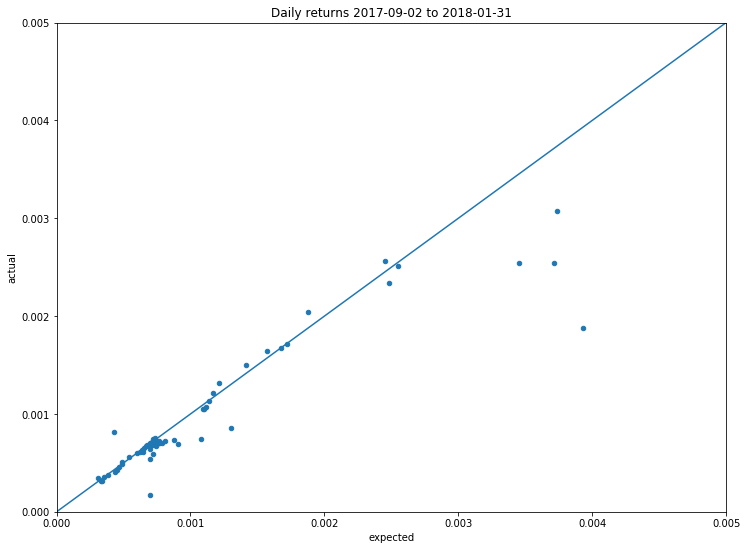

To estimate historical returns to margin lending, I used data from bfxdata.com. To cross-check the validity of the data, I compared the VWAR to my own realized VWAR in MarginBot:

As you can see, it’s a pretty good match. Some of the outliers are probably due to operational issues I had running MarginBot reliably when I first started using it, and during periods of high load on Bitfinex. Others may be the result of traders actively seeking to close high-rate loans early and replace them with cheaper financing – an effect I do not try to account for in my backtest.

BitMEX hedged short perpetual

BitMEX is a cryptocurrency derivatives exchange. Because futures positions do not have to be fully-funded, it provides an alternative to margin borrowing for traders who wish to take on leveraged positions in crypto.

One of the products that is listed on BitMEX is XBTUSD. This is a perpetual swap whose value is roughly anchored to the price of Bitcoin via a mechanism called “funding”. Specifically, every 8 hours, shorts will earn (and longs will pay) interest on the notional USD value of their positions at a rate F determined by the following formula:

F = P + Clamp(0.01% - P, -0.05%, 0.05%)

Where P is the average premium at which XBTUSD traded over the BitMEX Bitcoin reference rate in the last 8 hours. If P was zero, you would therefore earn 0.01% every 8 hour period i.e. 11.6% annualized just from the funding component. In practice, P tends to be positive, which makes the rate higher than this, but also much more volatile! (Note that if P is negative then shorts can end up paying longs rather than vice-versa.)

Shorting XBTUSD is a risky proposition, but you can neutralize this risk by going long spot Bitcoin. This means that any USD losses on your XBTUSD short will be exactly offset by gains in the value of the Bitcoin, but you’ll still earn the funding rate F.

Specifically, to initiate this trade you should:

- Buy

Qunits of Bitcoin at the prevailing cash priceC - Short

C*QUSD ofXBTUSDon BitMEX – you should be able to do this at a price not more than 0.1% fromC

The value of the portfolio created by steps 1 and 2 is Q*C USD, and if the Bitcoin cash price later changes to C' then it’s easy to see that the P&L on your Bitcoin position Q*(C'-C) USD should be offset exactly by that on the XBTUSD position C*Q*((1/C')-(1/C)) = Q*((C/C')-1) BTC i.e. Q*((C/C')-1)*C' = Q*(C-C') USD.

One wrinkle with this calculation is that it ignores the cumulative effect of the funding F. In the long term you hope that F will be positive. If it is, then your BitMEX margin account will be credited with Bitcoin with value equal to the interest you are owed. This will create long Bitcoin price risk, and you will need to explicitly “reinvest” in the strategy by shorting more XBTUSD to remain perfectly hedged and earn the compounded returns I simulate in my backtests. Equally, if F proves to be negative you will need to delever by buying back XBTUSD or else you will grow steadily more short Bitcoin.

You should probably transfer all/most the Bitcoin you purchased in the first step to BitMEX to act as margin for your XBTUSD short. This helps avoid the short being stopped out, which would leave you with unhedged long exposure to Bitcoin.

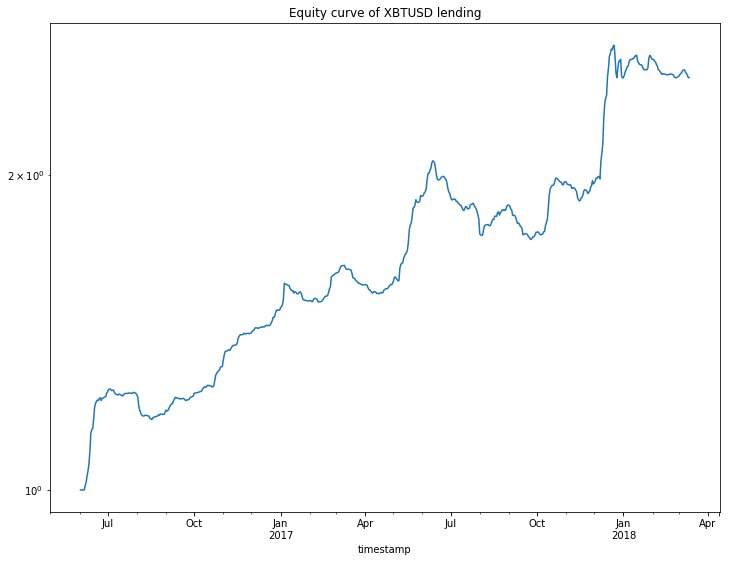

If you had followed this strategy historically you would have earned a healthy return with an annualized IR of 3.7:

| Annualized returns | |

|---|---|

| 2016-06-02 to 2016-12-29 | 98.7% |

| 2017 | 65.9% |

| 2017-04-21 to date | 69.0% |

| 2018 to date | -0.00239% |

(I highlight the 2017-04-21 breakpoint above because this is the date at which BitMEX changed their funding formula to use the fixed 0.01% rate mentioned above.)

The principal risks of this strategy are:

- BitMEX counterparty risk: BitMEX may be hacked or abscond with your deposits. They do appear to be careful about security but nothing is impossible.

-

Margin risk: traders on BitMEX do not have to fully-fund their positions. Therefore, to avoid imposing losses on the rest of the ecosystem BitMEX operate a system where a losing trader may have their positions liquidated in the market. Just as with the equivalent system at Bitfinex, there is no guarantee that this will be possible if the market is somehow disorderly, and in this case BitMEX might not be able to meet its obligations to other users.

As an ameliorating factor, BitMEX operates an insurance fund whose value currently stands at ~$40m. The fund is automatically topped up whenever a forced liquidation executes at a price better than expected, and the fund will be drawn upon to make traders whole in the event that BitMEX’s margining system fails.

-

Basis risk: in my P&L calculation above, I assumed that the price of

XBTUSDremains equal to that of spot Bitcoin. This is a somewhat reasonable assumption, given that the funding mechanism anchors the price very closely to the value of BitMEX’s .BXBT index, and that index is derived from quotes on two reputable exchanges that do not use Tether, but it’s not impossible to imagine that the two might become disconnected, leaving you less than perfectly hedged. - Premium risk: as you can see above, the strategy is far from riskless and hasn’t made any money this year at all. If the premium rate remains low/negative you can lose your initial capital even if nothing technically goes “wrong” with the trade.

BitMEX hedged short futures

As well as offering the XBTUSD perpetual swap, BitMEX lists traditional futures which settle at expiry to the Bitcoin USD price. You do not recieve/pay any funding cost when holding these futures, but it is usually the case that the futures trade at a premium to spot Bitcoin. This suggests another trading strategy, which is known as “cash and carry” in the BitMEX community:

- Buy

Qunits of Bitcoin at the prevailing spot priceC - Short

Q*FUSD of the current Bitcoin futures contract at the prevailing priceF > C - Sell your Bitcoin exactly at the final settlement price of the future i.e. sell it TWAP over the window 11:30-12:00 UTC on the expiry day.

Your initial position value is Q*C USD. If the final settlement price is C' then your final P&L is Q*(C'-C) USD from the spot position and Q*F*((1/C')-(1/F))=Q*((F/C')-1) BTC from the futures position i.e. Q*(F-C') USD.

Therefore, your total P&L is Q*(F-C') + Q*(C'-C) = Q*(F-C) USD. If k = F/C (i.e. k > 1) then this simplifies to Q*C*(k-1) USD i.e. you earn a certain return-on-capital of k-1.

Just like in the XBTUSD case above, you will want to deposit your spot Bitcoin on BitMEX to avoid your short being liquidated. Unlike in the XBTUSD case, you should never lose capital due to fluctuations in the funding rate – if funding costs are negative then you will able to see at the time of entry that k < 1, and you should simply choose not to trade at all.

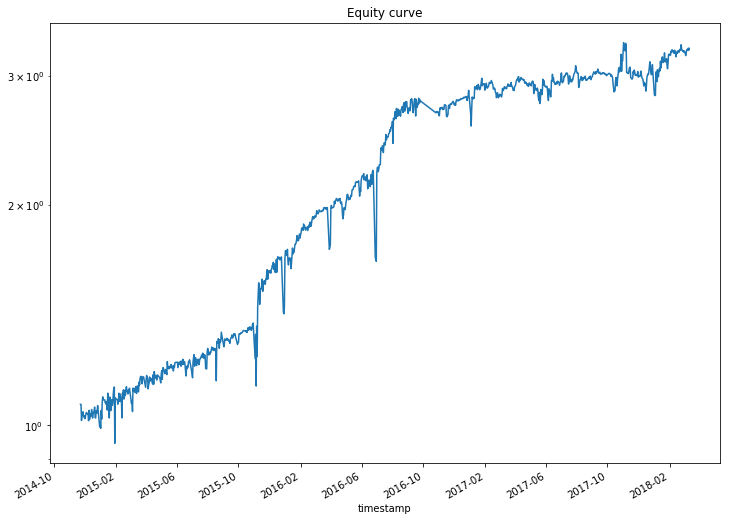

Returns to this strategy have been good but the IR is only 1 or so, probably due to the frequent spikes visible in the equity curve. (I suspect these spikes may be more an artifact of my backtest being slightly sloppy with timestamps, rather than a real effect.)

| Annualized returns | |

|---|---|

| 2015 | 47.2% |

| 2016 | 69.9% |

| 2017 | 16.9% |

| 2018 to date | 116% |

The key risks of this trade are:

-

BitMEX counterparty risk and Margin risk, just as described for

XBTUSDabove. - Fixed term lending risk: you should never lose money with this strategy, but this only applies if you hold the position until expiry. It is entirely possible that your mark-to-market P&L will be negative at some/all times before expiry. In this case, liquidating your position to recover the commited funds will cause you to take a loss.

-

Basis risk: the basis risks of this trade are similar to those of the

XBTUSDtrade, but there is one additional complication. It is BitMEX’s practice to derive the final settlement price strictly from the value of a Bitcoin on the expiry date. This means that in the event of a chain split that happens before contract expiry, the futures will settle at the value of the coin ex that distribution.It so happens that this policy actually benefits us as shorts, creating a new source of P&L: the value of a forked coin is always positive, so a fork announcment will tend to drive the value of the futures down while leaving the value of our spot bitcoin unaffected.

(This same rule actually created some extremely profitable trading opportunities around the SegWit2X split late last year. Traders on BitMEX did not seem to price in the value of the SegWit2X distribution, so it was possible to buy Bitcoin, short Bitcoin futures, and short SegWit2X futures on Bitfinex to lock in a large, deterministic profit.)

BitMEX hedged short altcoin futures

BitMEX lists futures contracts on some altcoins too (e.g. Ethereum, Dash, Ripple and Monero to name just a few). These futures settle to the value of the altcoin in XBT terms, but frequently trade at a premium to that spot price. This means that the following trade is profitable:

- Buy

Qunits of the altcoin at a priceB*CUSD, whereCis the price of Bitcoin in USD andBthe price of the alt in BTC. - Short

Qunits of altcoin futures at the prevailing priceE. - Short

Q*E*FUSD of Bitcoin futures at the prevailing priceF. - At futures expiry, sell your altcoins for USD.

Once the trade is closed out, your P&L will be as follows:

- Your spot position will earn

Q*(B'*C'-B*C)USD - Your altcoin futures short will earn

Q*(E-B')*C'USD - Your Bitcoin futures short will earn

Q*E*F*((1/C')-(1/F))*C'USD - If

j=E/Bandk=F/Cthen it is easy to verify that this amounts to a total P&L ofQ*B*C*(j*k - 1)USD – i.e. you will certainly make money so long asj*k > 1.

This trade has the advantage that it lets you “double-dip” in the futures premium - if both BTC and altcoin futures are trading at a premium, you can earn a return-on-capital that is roughly the sum of those premia. However, there are a number of serious issues with running the strategy in practice:

-

Margin call risk: you cannot deposit your long altcoin position on BitMEX to use as margin, because BitMEX only accepts Bitcoins as collateral. This means that you will have to source a (potentially unlimited) number of bitcoins from somewhere to keep your short alive in the event that it moves against you.

Not only does this introduce the risk that you may not be able to hold the position to expiry, but it also makes the return-on-capital of the strategy comparatively less attractive.

Adding to the seriousness of this issue, BitMEX does not operate a “portfolio margining” system. Imagine that the price of an altcoin remains absolutely fixed in USD terms, but Bitcoin experiences a huge price spike. If this happens, your short Bitcoin futures position will have significant negative P&L that will be offset almost completely by positive P&L on your altcoin futures short. Despite the fact that your account has no net P&L and so is not at risk of defaulting, BitMEX will nonetheless close out your Bitcoin short, leaving you unhedged against a Bitcoin price drop.

-

High trading costs: BitMEX has industry-leading fees of 7.5bps taker/-2.5bps maker for Bitcoin derivatives, but they charge a comparatively chunky 25bps taker/-5bps maker for the altcoins.

-

Thin markets: the altcoin futures markets are extremely illiquid in comparison to the Bitcoin ones. Not only can bid-ask spreads be very substantial, but this may also increase the risk of a adverse event where BitMEX’s automatic deleveraging is unable to liquidate busted positions at prices which avoid imposing losses on counterparties.

Quite apart from these concerns, all the standard risks associated with trading the BitMEX Bitcoin futures that we mentioned earlier still apply.

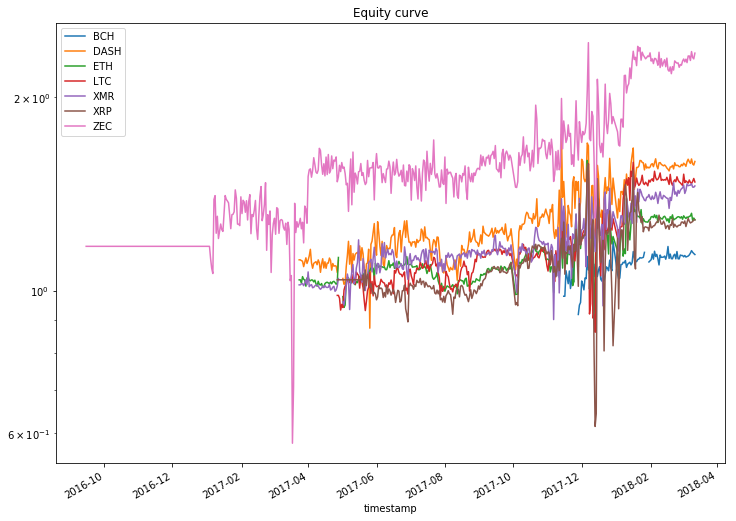

Altcoin futures seem to have been trading on BitMEX since early-to-mid 2017. The returns have been decent since that time:

| Coin | Annualized returns |

|---|---|

| BCH | 10.5% |

| DASH | 26.7% |

| ETH | 15.6% |

| LTC | 31.4% |

| XMR | 26.9% |

| XRP | 15.5% |

| ZEC | 59.2% |

Note that these returns are in Bitcoin terms – you could make an even higher risk-free profit in USD terms by also putting on the Bitcoin futures hedge as described above.

The equity curve looks even trashier than the XBT futures variant. This is probably due a combination of timestamp sloppiness and the fact that the only source for altcoin marks I could find was the Bitfinex daily price API, which does probably provide timestamps which are synchronized with BitMEX’s. These limitations mostly affect the mark-to-market P&L, so the overall return numbers above should still be trustworthy.

CryptoFacilities hedged short futures

This final strategy is a simple variant on the “BitMEX hedged short futures” strategy above, but adapted to CryptoFacilities, a FCA-registered and London based exchange offering futures on the XBT/USD, XRP/USD and XRP/XBT rates.

Because the XRP/USD futures are settled in Ripple, if you short them while holding an offsetting long Ripple position then you lock in a return on capital which depends only on the ex ante premium of the futures over the spot rate. This is entirely analagous to the long Bitcoin/short BitMEX Bitcoin futures trade.

CryptoFacilities offers contracts which expire roughly one week, one month, and 3 months ahead. Historically, it has been common for the weekly future to trade at a 1-2% premium to spot, and the quarterly contract frequently traded at a premium of 10-15%, so this trade has had annualized returns of 60-70%. Unfortunately I don’t have any backtest results to share with you here because it is not presently possible to get price data for expired contracts from the CryptoFacilities API (according to their support team they do plan to add this feature, but there is no ETA for this).

The risks of this trade are very similar to those of the BitMEX equivalent. However, you do face one risk that is unique to CryptoFacilities. On the CryptoFacilities platform, your counterparty for a trade is not CryptoFacilities themselves, but rather the customer that you traded with. In the event that the other customer has their positions liquidated, the CryptoFacilities system will try to buy them back in the market and assign the resulting positions to you so you aren’t left unhedged. However, this is a best-effort process which CryptoFacilities does not guarantee the success of, so if the system fails due to e.g. thin markets then you may have your own position closed out at an unfavourable price and with no recourse.

Closing words

The strategies outlined above have historically been able to return 50%+ annualized without any exposure to cryptocurrency price risk. In my opinion these are all examples where the market has mispriced risk, because the return has been more than sufficient to compensate for the expected value of the losses.

All the strategies are somewhat correlated, and their returns seem to depend on the level of speculative fervour in the crypto markets. This makes sense, because all of these strategies are just margin lending in one guise or another, and increased demand for speculative dollars should raise the cost of renting those dollars. This does mean that these strategies may be long crypto in a sense – while you may not lose any money if crypto tanks, you won’t make very much either!

Indeed, as of the time of writing, all of these strategies are offering very minimal returns of 5% or less annualized. This is doubtless related to the fact that we have been in a bear market for crypto for 3 months now. Because of these low returns, I’m not trading any of these strategies right now, but I stand ready to invest again should the market turn.

Finally, an obligitory note that you should not blindly follow the advice in this post! I’m just some dude on the internet with an unhealthy interest in financial market anomalies, not any kind of qualified investment manager or financial adviser.

Please note that all my backtests indicate returns that may not have been achievable historically (in particular, because I don’t account for trading costs), and may not be at all indicative of the returns that are available in the future. Even though these strategies try to avoid raw Bitcoin price risk, there are still substantial risks involved in implementing them, and you will have to decide for yourself whether those are suitable, after carefully considering all the factors.